Taxation of ULIPs

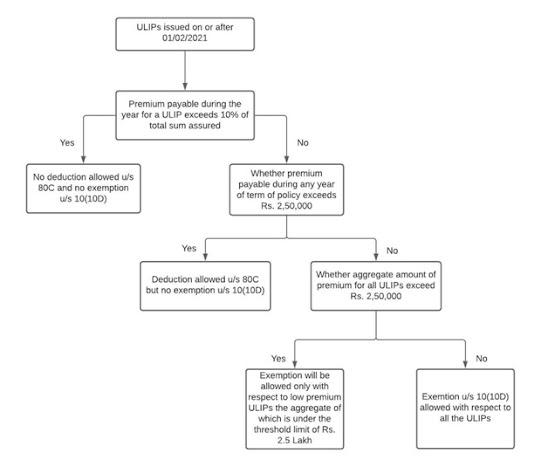

The Finance Bill, 2021 proposes to

tax certain Unit Linked Insurance Plans (ULIPs).The relevant change in the

taxation regime of ULIPs is proposed by withdrawing the exemption under Section

10(10D) in respect of such plans and consequently, taxing them under Section

112A of the Act.

It is proposed that no exemption

under Section 10(10D) shall be available in respect of ULIPs issued on or after

the 01-02-2021 if the amount of premium payable for any of the previous year

during the term of the policy exceeds Rs. 2,50,000. Further, if the premium is

payable by a person for more than one ULIPs, the exemption shall be available

only for those policies whose aggregate premium does not exceed Rs. 2,50,000,

for any of the previous years during the term of any of the policy (hereinafter

referred to as 'high premium ULIP').

The new taxation regime of ULIPs

shall apply only to those insurance policies which are issued on or after

01-02-2021. This article will answer all your questions about the taxability of

the ULIPs.

1. What is a Unit Linked Insurance

Plan?

Unit Linked Insurance Plan is a

hybrid investment option which consists of a mix of insurance and investment to

serve the needs of the respective investors. The amount of premium of a ULIP

scheme is partly towards the insurance of the policyholder and partly towards

the investment. The investable portion of the premium is invested in equity,

debt, money market or a mix of all based on the goals and risk appetite of the

investor.

2. What are the types of ULIPs?

An investor can invest in the ULIPs

for his retirement planning, wealth-creation, child-education, family security,

so on and so forth. ULIPs, by and large, allow options of payment of

single-premium or regular premium. ULIPs based on the types of portfolios the

money of insurer is invested in, can be categorized into the following:

(a) Equity-Based Funds;

(b) Debt-Based Funds;

(c) Money Market Based Funds;

and

(d) Balanced Funds.

3. Difference between ULIP, Life

insurance and Mutual Funds

|

Basis of difference |

ULIP |

Mutual Funds |

Life insurance Plans |

|

Definition |

ULIP are the hybrid plans

providing the investor with the insurance cover and investment both. |

Mutual Funds are purely Investment

tools. People can invest in different types of MF according to their return

expectation, risk-taking capabilities etc. |

Life insurance plans provide the

policy-holder insurance cover and are not considered for investments. |

|

Premium |

The premium can be paid in a lump

sum or can be paid at regular intervals at the option of the investor. |

Mutual Funds do not require

regular payment except in case of SIPs. |

The premium can be paid either in

a lump sum or can be paid at regular intervals at the option of funds the

investor. |

|

Tax Incentives |

Premium paid is eligible for

deduction under section 80C and the amount received at the time of maturity

is eligible for exemption under Section 10(10D) subject to certain

conditions. |

No tax incentive is provided for

the amount invested in Mutual Funds except for Equity Linked Savings Scheme

(ELSS) funds. Deduction under section 80C is allowed for the amount invested

in ELSS funds. |

Premium paid is eligible for

deduction under section 80C and the amount received at the time of maturity

is eligible for exemption under Section 10(10D) subject to certain

conditions. |

|

Maturity |

At the time of maturity, repayment

is made on the prevailing price of the units. |

At the time of

transfer/withdrawal, the amount is paid on the prevailing price of the units. |

At the time of maturity/death, the

pre-determined capital sum assured is paid to the policyholder. |

|

Switching |

The investor can switch between

different types of portfolios as per his requirements. If the redemption of

the ULIPs is exempt from tax under Section 10(10D), no capital gain shall

arise in the hands of the investor if he opts to switch between the types of

funds within the same insurer. If redemption/maturity is not exempt from tax,

the switching of funds between different schemes shall be chargeable to

tax.Also refer the FAQ No. 12. |

Switching between the schemes of

mutual funds is allowed. Such switching happens by way of redemption of

existing units, thus, it is considered as transfer under the Income-tax Act

and accordingly, charged to capital gains tax. |

No switching is allowed between

different schemes. |

|

Risk |

The returns under the ULIP scheme

are subject to market risk. Value of the fund would depend upon the type of

funds the investor has opted to invest the money. |

The returns are market-linked and

are subject to the fluctuations. |

There is no risk involved in life

insurance policies. |

4. Is there any lock-in period of

investment in ULIP?

ULIPs typically have a lock-in

period of 5 years.

5. Whether deduction allowed under

Chapter VI-A for investment in ULIPs?

Yes, deduction under Section 80C is

allowed for the investment made in ULIP. An Individual can claim a deduction

for the investment made for himself, spouse or children (dependent or

independent) and HUF can claim a deduction for the investment made for any

member of HUF.

Deduction under section 80C is restricted

to 10% of the actual capital sum assured. It means that if the person pays an

exorbitant premium for an insurance cover, the deduction shall not be allowed

for the entire premium. The deduction will be limited to 10% of the sum

assured, and any amount of premium paid more than this limit is not deductible

under Section 80C.

Investment in ULIP is generally

spread over 10 years or 15 years. The deduction is allowed only if the taxpayer

contributes to ULIP for first five years of the plan. If he stops contributing

in the plan before the expiry of five years or he terminates his participation

by notice to that effect, the aggregate of deductions allowed to him in the

earlier years shall be deemed as his income and charged to tax in the year in

which such termination or cessation occurs.

No changes have been proposed to

Section 80C by the Finance Bill, 2021. The deduction under Section 80C shall

not be allowed in the event of payment of excess premium (more than 10% of the

sum insured), while as it will continue to be deductible in case of higher

premium (more than Rs. 250,000).However, the deduction under Section 80C shall

not exceed Rs. 1,50,000.

6. When an exemption is allowed

under Section 10(10D)for the sum received under ULIP? (Before the Budget)

Section 10(10D) provides for

exemption with respect to any sum received under ULIP, including the sum

allocated by way of bonus on such policy. However, if the premium payable for

any of the years during the term of the policy exceeds 10% of the actual capital

sum assured, then no exemption under this section would be allowed with respect

to the sum received under the policy. Such situation hereinafter referred to as

'excess premium'.

7. When an exemption is allowed

under Section 10(10D) for the sum received under ULIP? (After the Budget)

Besides restricting the exemption

under Section 10(10D) for payment of excess premium, the Finance Bill, 2021 has

proposed to insert Fourth and Fifth Proviso to Section 10(10D) that no

exemption shall be available under this provision in respect of ULIPs issued on

or after the 01-02-2021, if the amount of premium payable for any of the

previous year during the term of the policy exceeds Rs. 2,50,000 (i.e., 'high

premium' ULIPs).

The Fourth Proviso provides

that no exemption shall be available for a policy, acquired on or after

01-02-2021, if the premium paid in any year during the tenure of the ULIP

exceeds Rs. 2,50,000 (single policy).So, where premium payable for a policy

exceeds Rs. 2.5 lakhs in any year during its tenure, no exemption under section

10(10D) will be allowed with respect to such policy.

The Fifth Proviso provides

the exemption for all those policies whose aggregate premium in any year during

the tenure of the policies is less than Rs. 2,50,000 (Multiple Policies). This

would imply that in case the person has more than one policy acquired on or

after 01-02-2021, and the premium payable for each of such policy during any

year does not exceed Rs. 2.5 lakhs but the aggregate of premium payable for all

such policies exceeds Rs. 2.5 lakhs in a year, the exemption under this section

would be allowed only in respect of those policies whose aggregate premium is

within such prescribed limit.

Thus, in other words, exemption

shall be allowed only with respect to low premium ULIPs the aggregate of which

is under the threshold limit of Rs. 2.5 Lakh. .

Example 1: Determine whether the

exemption is available under Section 10(10D) for a single policy purchased by

four different persons in the following scenarios.

|

Particulars |

Person A |

Person B |

Person C |

Person D |

|

Date of investment in ULIP |

31-12-2020 |

15-01-2021 |

15-02-2021 |

28-02-2021 |

|

Premium payable every year (In

lakhs) |

2.60 |

2.00 |

2.30 |

2.55 |

|

Sum assured (In lakhs) |

50.00 |

18.00 |

20.00 |

35.00 |

|

Whether the amount of premium

exceeds 10% of the capital sum assured? |

No |

Yes |

Yes |

No |

|

Whether the amount of premium

during the year exceeds Rs. 2.5 lakhs? |

Not applicable |

Not applicable |

No |

Yes |

|

Whether exemption available under

Section 10(10D)? |

Yes |

No |

No |

No |

Example 2: Determine whether the

exemption is available under Section 10(10D) for multiple policies purchased by

one person on or after 01-02-2021 in the following scenarios.

|

Particulars |

Premium payable every year |

Capital sum assured |

Whether premium exceeds 10% of

capital sum assured? |

Whether premium exceeds Rs.

2,50,000 |

Whether eligible for exemption

under Sec. 10(10D)? |

|

(In lakhs) |

(In lakhs) |

||||

|

Policy A |

2.60 |

26.00 |

No |

Yes |

No |

|

Policy B |

2.00 |

15.00 |

Yes |

No |

No |

|

Policy C |

1.25 |

10.00 |

Yes |

No |

No |

|

Policy D |

0.60 |

5.00 |

Yes |

No |

No |

|

Policy E |

1.00 |

80.00 |

No |

No |

Yes* |

|

Policy F |

0.60 |

60.00 |

No |

No |

Yes* |

|

Policy G |

0.90 |

10.00 |

No |

No |

Yes* |

|

Policy H |

0.85 |

9.00 |

No |

No |

Yes* |

* Though the last four policies are

eligible for exemption under Section 10(10D) but the exemption can be claimed

in respect of only those policies whose aggregate premium during the year does

not exceed Rs. 2,50,000 (i.e., low premium policies). Further, the threshold

limit of Rs. 2,50,000 should be exhausted for those low premium policies first

which have a higher yield. Low-yield ULIPs should be avoided from exhausting

the limit of Rs. 2,50,000. It will, in turn, reduce the ultimate taxable

capital gains. If the yield from such eligible policies is the same, the

investor should consider Policy E, F and G as the aggregate premium of such

policies equal to Rs. 2,50,000. If policy H is included, the limit of Rs.

2,50,000 cannot be exhausted fully.

8. Whether there is any change in

the taxability in the event of the death of the policy-holder?

In the event of the death of the

policy-holder, the exemption shall not be denied under Section 10(10D) from

either of the policy, that is, excess premium policy (more than 10% of

sum assured) or higher premium policy (more than Rs. 2,50,000).

9. Under which head the sum received

from ULIPs shall be taxable?

As Income-tax Act does not contain

any guidance on this aspect, the income arising in the event of disallowing the

exemption under Section 10(10D), it used to be taxable under the head 'capital

gains'. The reasoning behind this is that when a person takes an insurance

policy, he gets the right to receive sum due against his insurance policy

either on maturity or on its surrender or mis happening. Therefore, the right

to receive a sum from the insurance policy is a capital asset within the

meaning of section 2(14) and any income or losses arising on its transfer shall

be chargeable to tax under the head 'Capital Gains'. If an insurance policy has

been held for more than 36 months, it shall be considered as long-term capital

assets, accordingly the benefit of cost inflation index shall be given while

computing the capital gains.

However, as the Finance Bill, 2021

proposes that only those ULIP shall be considered as 'capital asset' to which

exemption under Section 10(10D) does not apply, on account of the applicability

of the fourth and fifth proviso thereof. This amendment, thus, keeps

only the high-premium policies within the meaning of 'capital asset', which, in

turn, gives an impression that excess-premium policies (more than 10% of sum

assured) shall not be considered as a capital asset. This does not seem to be

logical but seems to be an inadvertent error. If this aspect is ignored, the

proceeds from the excess premium policies shall also be taxable under the head

capital gains. If not, proceeds from such excess-premium policy should be

taxable as residuary income or alternatively, it could be argued that in

absence of its inclusion within the meaning of 'income' under Section 2(24), it

should be treated as capital receipts not chargeable to tax.

If it is assumed that excess-premium

and high-premium policies are taxable under the head capital gains, the former

one will be taxable at applicable tax rates in case of short-term capital gains

and at the rate of 20% with indexation in case of long-term capital gains.

Whereas, the taxability of the high-premium policies will depend upon the

nature of policy and chargeability of STT thereon. If such ULIPs are

equity-oriented and chargeable to STT, the tax shall be levied at the rate of

15% in case of short-term capital gain (section 111A) and at the rate of 10% in

case of long-term capital gain (Section 112A). In other cases, the taxability

shall be same as in case of excess premium policy (for more details about

the tax rates applicable in case of excess-premium and high premium policies,

refer to Question 11).

10. How much amount shall be charged

to tax under the head capital gains?

The Finance Bill, 2021 proposes to

insert a new sub-section (1B) to Section 45 to provide that where any person

receives at any time during any previous year any amount under a ULIP, to which

exemption under Section 10(10D) does not apply on account of the fourt hand

fifth proviso thereof, including the amount allocated byway of bonus on such

policy, then, any profits or gains arising from receipt of such amount by such

person shall be chargeable to tax under the head "Capital gains" in

the previous year in which such amount was received. Further, the income

taxable under this head shall be calculated in such manner as may be

prescribed. Thus, the manner of computation of income shall be notified

subsequently.

11. How much is the tax rate on such

capital gains?

The definition of 'Equity Oriented

Fund' in Section 112A is proposed to be amended by the Finance Bill, 2021. It

is proposed to cover ULIPs to which exemption under Section 10(10D) does not

apply on account of the applicability of the fourth and fifth proviso

thereof. The said definition contains a condition thatatleast65% of the total

proceeds of such ULIPs in the equity shares of domestic companies listed on a

recognised stock exchange. This condition shall continue to apply to a ULIP

policy for its taxability under this provision. Thus, only High Premium

Equity-Oriented ULIPs shall be taxable under Section 112A or Section 111A, as

the case may be. Gains arising from other ULIPs (debt based, balanced, etc.)

shall be taxable as per general provisions.

The tax rate on the capital gains

depends upon the nature of capital asset (short-term or long-term), which is

determined on the basis of its period of holding. A capital asset is generally

treated as long-term capital asset if it is held for more than 36 months

immediately preceeding the date of its transfers otherwise the same shall be

treated as short-term capital assets. However, the period of 36 months is

treated as 12 months in case units of Equity-Oriented Fund. The period of

holding to determine long-term or short-term capital gain after the amendment

proposed by Finance Bill, 2021 shall be as follows:

|

ULIP |

Period

of holding to qualify as long-term capital asset |

|

Equity Oriented |

|

|

- High premium

policies |

More

than 12 months |

|

- Other

policies |

More

than 36 months |

|

Other than equity oriented |

|

|

- High premium |

More

than 36 months |

|

- Other

policies |

More

than 36 months |

Once the nature of capital gain is

determined on basis of period of holding of ULIPs, the tax rate shall depend

upon the type of ULIP and the chageability of STT thereon. This can be

explained with the help of following flow charts:

12. What is Fund Switching in ULIPs?

In the ULIPs, the policyholders have

an option to switch between different types of funds (equity, debt,

money-market or balance) or allocate money in a variety of funds. They can opt

to switch the investment funds fully or partially into different portfolios

according to their future needs and their risk appetite. As per the IRDA (Unit

Linked Insurance Products) Regulations, 2019, the investment pattern can be

switched by moving from one segregated fund either wholly or partly to other

segregated funds amongst the segregated funds offered under the underlying Unit

Linked insurance product of an insurer. There are generally no charges

applicable for switching between the types of funds. Many insurers provide a

particular number of free switches a person can make within a year, and

additional charges are applicable in case he opts to switch beyond that limit.

No tax implications would arise on

such switching from one fund to the other provided the maturity/redemption of

units of ULIPs are exempt under Section 10(10D). If no such exemption is

available for the excess premium or high-premium policies, such switching

between the funds may be taxable under the head capital gains. However, the

CBDT should provide clarity on this aspect.

13. Whether STT be levied on

transfer/ redemption of ULIPs?

STT is required to be collected by

the trustee or any other managing the funds in case of mutual funds or

recognised stock exchange in case of any other specified securities transacted

through a recognised stock exchange.

Finance Act, 2021 has proposed to

amend various provisions under Finance (No. 2) Act, 2004 to enable levy of STT

on amount received by the policyholder at the time of maturity or partial

withdrawal with respect to ULIPs issued on or after 01/02/2021. Levy of tax in

case of ULIPs has been brought on the similar lines as in case of equity

oriented mutual fund units issued in respect of ULIPs. STT will be levied if

all the following conditions are satisfied:

1. The ULIP is issued on

or after 01/02/2021

2. Policyholder has

transferred units of equity oriented funds issued by the insurer with respect

to ULIPs;

3. Amount is received

due to sale or surrender or redemption of the units on account of maturity or

partial withdrawal.

STT will be levied at the rate of

0.001% on the value of transaction and is required to be paid by the seller of

the units. Amendment in other provisions regarding furnishing of return and

collection and recovery of STT has also been proposed by ensuring the same

provisions are applicable in case of above mentioned ULIPs and equity oriented

mutual funds.

No comments:

Post a Comment